Avoiding Predatory Lenders: Smart Tips to Protect Yourself the Next Time You Buy a Car

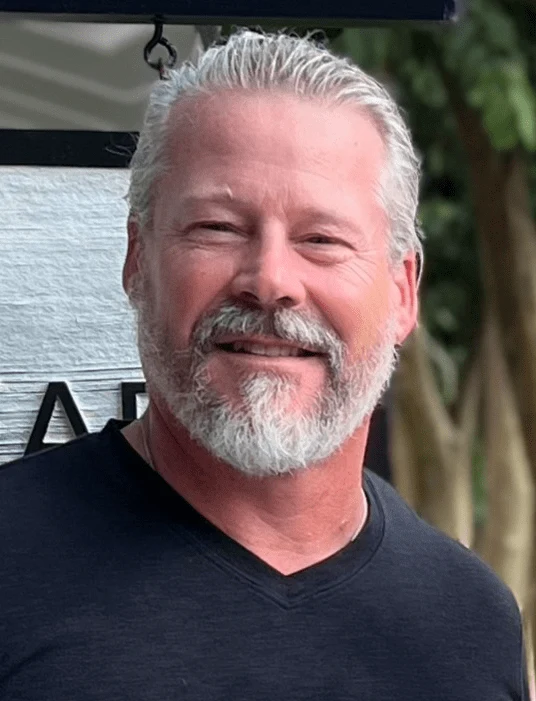

by Tiger Okeley, an Executive Board Member for Indiana Finance Company and Oak Motors. Tiger has over 40 years of expertise in the Buy Here Pay Here industry. He is dedicated to providing innovative transportation solutions and empowering underserved customers through socially and financially responsible practices.

People with challenged credit face many hurdles when trying to get a loan. Borrowing is often more expensive for them, and they don’t have access to as many options, which limits their ability to shop around. Add to that the stigma that can come with a low credit score, and it’s easy to see why some borrowers struggle to advocate for themselves.

This lack of options, combined with financial urgency, makes subprime borrowers vulnerable to predatory lenders. That’s why understanding the lending landscape is key before making a major purchase like a car.

How Do You Know if You’re a Subprime Borrower?

Subprime borrowers are typically consumers with FICO credit scores below 670. To check your score, start with your credit card provider or bank, many of which offer free access. Borrowers can also find their FICO scores by checking with one of the three main credit bureaus: Equifax, Experian, and TransUnion. Everyone can receive one free credit report annually from each reporting agency through annualcreditreport.com. While the report won’t include a FICO score, it allows you to review your history and dispute any errors. Blemishes like late payments and bankruptcies take the largest bites out of a credit score. However, other factors like medical debt or identity theft can also put people in precarious financial positions. The best course of action for someone with a low FICO score is to begin paying off debt and establishing good payment histories. Unfortunately, this is a complex and time-consuming process. It isn’t always feasible for a subprime borrower to simply sit out of the lending market. They may still need to make large purchases — particularly vehicles. After all, access to reliable transportation is essential. However, it’s difficult for the average person to save enough money to buy a car, so they often have no choice but to finance their purchase.

Dealership Options for Subprime Borrowers

Fortunately, subprime borrowers have options for financing a vehicle purchase. However, not all subprime lenders are the same, and understanding those differences will help them make smarter decisions.

Traditional Dealerships

Many traditional dealerships work with outside lenders to offer financing for subprime buyers. This can provide more vehicle options, but often lacks long-term support. Sales teams are typically focused on closing the deal, not helping customers stay on track with payments. If the buyer runs into trouble paying back their loan, the lender may offer them limited support but won’t go out of their way to ensure their customers complete the loan terms.

Buy Here Pay Here Dealerships

Buy Here Pay Here (BHPH) dealerships handle both the sale and financing directly. This gives them a greater stake in their customers’ success. Some, like Oak Motors, go a step further by including support services like limited warranties, repair financing, or insurance assistance—all built into the loan. These programs are designed to help borrowers stay current and avoid defaulting, even when life throws a curveball.

Strategies to Stay Ahead of Bad Actors

Of course, buyers can encounter bad actors at every type of dealership. Here are a few tips people with low credit scores can use to judge whether a deal is fair or if it’s being offered by someone looking to take advantage of a vulnerable borrower:

1. Research the Market

Learning about the subprime credit market is one of the best ways to avoid falling victim to predatory lenders. It’s important to understand that lenders won’t negotiate loan terms. They are required to treat everyone the same because if they don’t, they could be accused of lending discrimination. Consequently, buyers likely won’t see much difference in rates between lenders.

Subprime borrowers will pay higher interest rates than those with good credit. Rates vary by state, but many lenders charge close to the legal maximum. By comparing multiple dealerships and understanding the range of services included, you can find the best overall deal.

2. Don’t Overbuy

Buyers should also carefully consider the type of car they’re shopping for. It would be easy to get seduced by the fancy SUV with all the latest bells and whistles instead of the reliable sedan that gets great gas mileage. Some bad actors would also be happy to sell that fancy SUV without bothering to mention that the sticker price is only part of the total cost of ownership. Newer, more expensive automobiles often come with higher costs for things like insurance, maintenance and fuel. These added costs could ultimately make a vehicle unaffordable.

Reliability is also an essential consideration. Buyers should be reasonably confident that the car they’re purchasing will last well beyond their loan term. If not, they could be left making monthly payments on a vehicle that doesn’t run. That’s why buyers with challenged credit should choose the least expensive and most reliable vehicle to meet their needs. This most likely won’t be the flashiest car on the lot.

3. Keep Loan Terms as Short as Possible

The length of a loan term is also a crucial consideration. A high interest rate combined with an extended payment term means that a buyer will pay considerably more for a vehicle than someone purchasing with cash. Vehicles also depreciate over time, creating the real possibility of a buyer owing more than their car is worth on the market.

Many subprime loans extend to 72 or even 84 months so that the borrower’s monthly payments will be lower. There are plenty of bad actors who wouldn’t think twice about offering an extended loan term if it meant selling someone a vehicle.

Aim for the shortest loan term you can afford. It may cost more each month, but you’ll pay less overall and be free of the loan sooner. Plus, you’re more likely to still have a working vehicle by the end of the term.

4. Take Advantage of Support Programs

Some BHPH dealerships offer more than just financing. They include perks like free oil changes, repair loans, and warranty programs — all of which can help keep you on track. These aren’t just nice extras; they can be critical for people working to improve their credit and avoid future setbacks. If you find a dealer that’s willing to invest in your success, that’s a good sign they’re not just looking to make a quick sale.

Breaking the Cycle with Knowledge

Buying a car with challenged credit can feel overwhelming, but the right approach can empower subprime borrowers to make confident, informed decisions. While limited options and predatory lenders are real concerns, knowledge is the best defense. By researching the market, choosing vehicles strategically, opting for shorter loan terms and seeking out dealerships that offer meaningful support programs, buyers can find financing arrangements that work for their circumstances. While subprime borrowers will likely face higher interest rates, choosing the right dealer and right vehicle can help turn a challenging situation into an opportunity to rebuild credit and establish a strong financial foundation. At Oak Motors, we’re not just here to sell cars. We’re here to help you break the cycle and build a stronger financial future. If you’re ready to explore your options, we’re ready to help — every step of the way.

Categories

Recent Posts

Popular Tags

Related posts

What To Look For In A Car: Choosing The Right Vehicle

How to Winterize Your Car: Winter Car Tips

What to Know About Warranties When Buying a Used Car

Website Links

Pages

- About Us

- Blog

- Contact Us

- Financing

- Get Pre-Qualified

- Home

- Legal Notice

- mobiletest

- New Home

- Online Payment

- Panel

- Privacy Policy

- Referral Program

- Schedule Service

- test-home

- Trade In

- Ultimate Protection Plus

- Used Car Dealership In Anderson Indiana

- Used Car Dealership In Indianapolis East Indiana

- Used Car Dealership In Indianapolis South Indiana

- Used Car Dealership In Indianapolis West Indiana

- Used Car Dealership In Muncie Indiana

- Used Cars For Sale In Anderson

- Used Cars For Sale In Indianapolis East

- Used Cars For Sale In Indianapolis South

- Used Cars For Sale In Indianapolis West

- Used Cars For Sale In Muncie

- Visit Us

Makes

Article Categories

Articles

- AWD vs 4WD: What’s The Difference?

- What To Look For In A Car: Choosing The Right Vehicle

- How to Winterize Your Car: Winter Car Tips

- What to Know About Warranties When Buying a Used Car

- Guide to Buying a Used Car

- Tips for Car Trade-Ins

- Does Buying A Car Help With Taxes?

- Achieve Long-Term Savings Through Regular Car Maintenance

- How Car Buying Can Help Build Credit – Even After Bankruptcy

- What to Avoid When Buying a Used Car

- 10 Questions to Ask Yourself Before Buying a Car

- Avoiding Predatory Lenders: Smart Tips to Protect Yourself the Next Time You Buy a Car