10 Questions to Ask Yourself Before Buying a Car

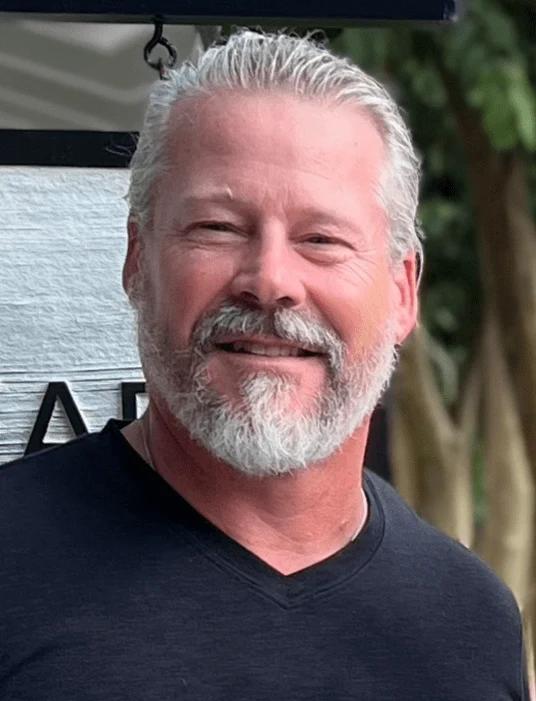

by Tiger Okeley, an Executive Board Member for Indiana Finance Company and Oak Motors. Tiger has over 40 years of expertise in the Buy Here Pay Here industry. He is dedicated to providing innovative transportation solutions and empowering underserved customers through socially and financially responsible practices.

Buying a car isn’t just about picking a color and finding a good deal. It’s a major life decision that can impact your finances, lifestyle and long-term goals. For many people, the need for a car doesn’t always align with the perfect moment to buy one. Maybe your old vehicle finally gave out, or your job situation changed, and now you need reliable transportation-fast.

But even in those urgent moments, taking a step back to ask the right questions can save you money, stress and regret down the road. With constant changes in the economy and the rising cost of goods, getting clear on your readiness and needs before buying is more important than ever. Here are 10 essential questions to ask yourself before buying a car:

1. Do I need a car right now, or do I want one?

Making a thoughtful decision about purchasing a car means understanding both your needs and your wants. Most of us never buy something we don’t want—desire is always part of the equation. The key is to be prepared and mindful. Is your current car no longer reliable, or are you simply eyeing an upgrade? Both are valid, but recognizing the difference can help you avoid letting a want overshadow a need. A responsible purchase balances practicality with aspiration, especially when financial and global conditions demand greater awareness.

2. What's my realistic budget-upfront and monthly?

A car’s sticker price is only the beginning. You must also account for taxes, fees, insurance, maintenance and fuel. And if you’re financing, consider what your monthly payments will look like, especially with today’s high interest rates. Create a realistic budget that includes the total cost of ownership-not just the down payment.

3. Have I checked my credit score?

Your credit score heavily influences your financing terms. A higher score can land you better rates, which could save you thousands over the life of the loan. If your score isn’t quite where you’d like it to be, it may be worth taking a little time to improve it-unless you’re facing an urgent need.

Even so, you’re not without options. Dealerships like ours specialize in working with all types of credit. Because we offer in-house financing, we can help you get into a vehicle while also allowing you to rebuild your credit. We’re committed to your success-after all, we only succeed when you do.

4. Should I buy new or used?

Each option has its pros and cons. New cars come with warranties and modern features but depreciate quickly. Used cars are often more affordable but may require more maintenance. If you’re considering used, buying from a dealership can offer more peace of mind with warranties and other perks. Just be sure to watch for common pitfalls. Match your choice to your lifestyle, budget and long-term plans.

5. Have I researched what kind of car fits my actual needs?

Think function first. Do you commute long distances? Haul equipment? Need extra seating for kids? A flashy sports car might look cool, but won’t do much good if you need trunk space for groceries or all-wheel drive for snowy commutes.

Bonus Tip: Write down your top three non-negotiables for your next car. Whether it’s fuel efficiency, safety features, or cargo space, knowing what matters most will help you cut through the noise and make a smart, confident decision.

6. Have I compared models, prices and reviews?

There are dozens of options in every category. Spend time reading reviews, watching video breakdowns and comparing specs across brands. Researching which vehicles may be more reliable or have the least amount of issues could help in the long run. Most dealerships post inventory online now, so you can research before stepping onto a lot. When you’re ready to test drive, you’ll know exactly what to look for.

7. Am I aware of current economic issues that could affect the cost?

It’s important to stay aware of economic factors that are either currently in flux or could change soon—not necessarily to determine if now is the “right” or “wrong” time to buy but to understand how these shifts might impact your financial stability and flexibility. For example, if gas prices are high and you’re looking at a vehicle with low fuel efficiency, that choice could hit your wallet hard month after month.How well does your budget absorb that cost now, and how much wiggle room do you have if things get worse? Thinking through scenarios like this can help you weigh the potential tradeoffs, reduce anxiety and make a decision that fits your life—whether that means moving forward or holding off. The goal is to feel confident you can meet your obligations and still enjoy the experience.

8. Have I gotten pre-approved for a loan or checked financing options?

Most people don’t have the cash to buy a car outright-that’s totally normal. Financing helps bridge that gap, and getting pre-approved can give you a clearer sense of what you can afford. Some dealerships, like ours, offer in-house financing and work with all credit types, which can be a big help if you’re rebuilding your credit.

9. Have I considered insurance costs?

This is often an afterthought, but insurance premiums can vary dramatically depending on the car’s make, model, year and safety ratings. Before you fall in love with a vehicle, call your insurer or use online tools to get a quote. The difference between models can be hundreds of dollars per year.

10. Have I taken the car for a thorough test drive (and inspection)?

This is especially important with used cars. A quick loop around the block isn’t enough. Take the car on highways, local roads and parking lots. Listen for odd sounds, feel how it handles, and check under the hood if you’re comfortable doing so. If you’re unsure what to look for, bring a checklist-or better yet, get a trusted mechanic to check it out.

Final Thoughts: Be Prepared, Not Pressured

Buying a car is rarely about perfect timing. Life often forces the decision on us-your car breaks down, your lease ends or you move to a city where public transportation isn’t cutting it. In those moments, it’s easy to feel overwhelmed or rushed.

But even if you can’t control the timing, you can control how prepared you are.

Ask yourself these questions. Do your homework. Stay informed about industry trends and policy shifts that could affect pricing. And most importantly, make sure your purchase fits your life and your budget, not someone else’s sales quota. Reach out to us if you have any questions-we’re happy to help!

Categories

Recent Posts

Popular Tags

Related posts

What To Look For In A Car: Choosing The Right Vehicle

How to Winterize Your Car: Winter Car Tips

What to Know About Warranties When Buying a Used Car

Website Links

Pages

- About Us

- Blog

- Contact Us

- Financing

- Get Pre-Qualified

- Home

- Legal Notice

- mobiletest

- New Home

- Online Payment

- Panel

- Privacy Policy

- Referral Program

- Schedule Service

- test-home

- Trade In

- Ultimate Protection Plus

- Used Car Dealership In Anderson Indiana

- Used Car Dealership In Indianapolis East Indiana

- Used Car Dealership In Indianapolis South Indiana

- Used Car Dealership In Indianapolis West Indiana

- Used Car Dealership In Muncie Indiana

- Used Cars For Sale In Anderson

- Used Cars For Sale In Indianapolis East

- Used Cars For Sale In Indianapolis South

- Used Cars For Sale In Indianapolis West

- Used Cars For Sale In Muncie

- Visit Us

Makes

Article Categories

Articles

- AWD vs 4WD: What’s The Difference?

- What To Look For In A Car: Choosing The Right Vehicle

- How to Winterize Your Car: Winter Car Tips

- What to Know About Warranties When Buying a Used Car

- Guide to Buying a Used Car

- Tips for Car Trade-Ins

- Does Buying A Car Help With Taxes?

- Achieve Long-Term Savings Through Regular Car Maintenance

- How Car Buying Can Help Build Credit – Even After Bankruptcy

- What to Avoid When Buying a Used Car

- 10 Questions to Ask Yourself Before Buying a Car

- Avoiding Predatory Lenders: Smart Tips to Protect Yourself the Next Time You Buy a Car